Industries We Serve

Who We Serve

Strategic M&A Support for Complex, Competitive Sectors

At First Turn Capital, we advise mid-market companies across high-impact industries—helping business owners buy, sell, and scale with confidence. Our clients typically generate $5M–$250M in revenue and $2M+ EBITDA, and they’re looking for more than just a transaction. They want strategy, structure, and real results.

We specialize in sectors where timing, structure, and execution create outsized value. Whether you’re planning an exit, acquiring a competitor, or growing through capital restructuring, we bring the experience to get your deal done—on your terms.

Where We Work

We Know the Industries Where Value Is Built in the Details

Our team brings deep expertise across industries where market cycles, operational complexity, and owner-led leadership shape the path forward. Here's where we thrive:

Oil & Natural Gas

From upstream exploration to midstream logistics, we work with energy companies navigating consolidation, succession, and private equity-backed acquisitions.

Downstream & Midstream

We support infrastructure-heavy operators seeking growth capital, bolt-on acquisitions, or a premium sale to strategic buyers.

Construction Supply

Construction product manufacturers and distributors trust us to guide expansion strategies, recapitalizations, and market roll-ups in a competitive, margin-sensitive space.

Equipment Rental

We help asset-heavy rental businesses assess value, restructure debt, and pursue strategic M&A while optimizing cash flow and operations.

Industrial Infrastructure

For project-based firms and infrastructure contractors, we offer advisory built for long cycles, contract dynamics, and unique deal structures.

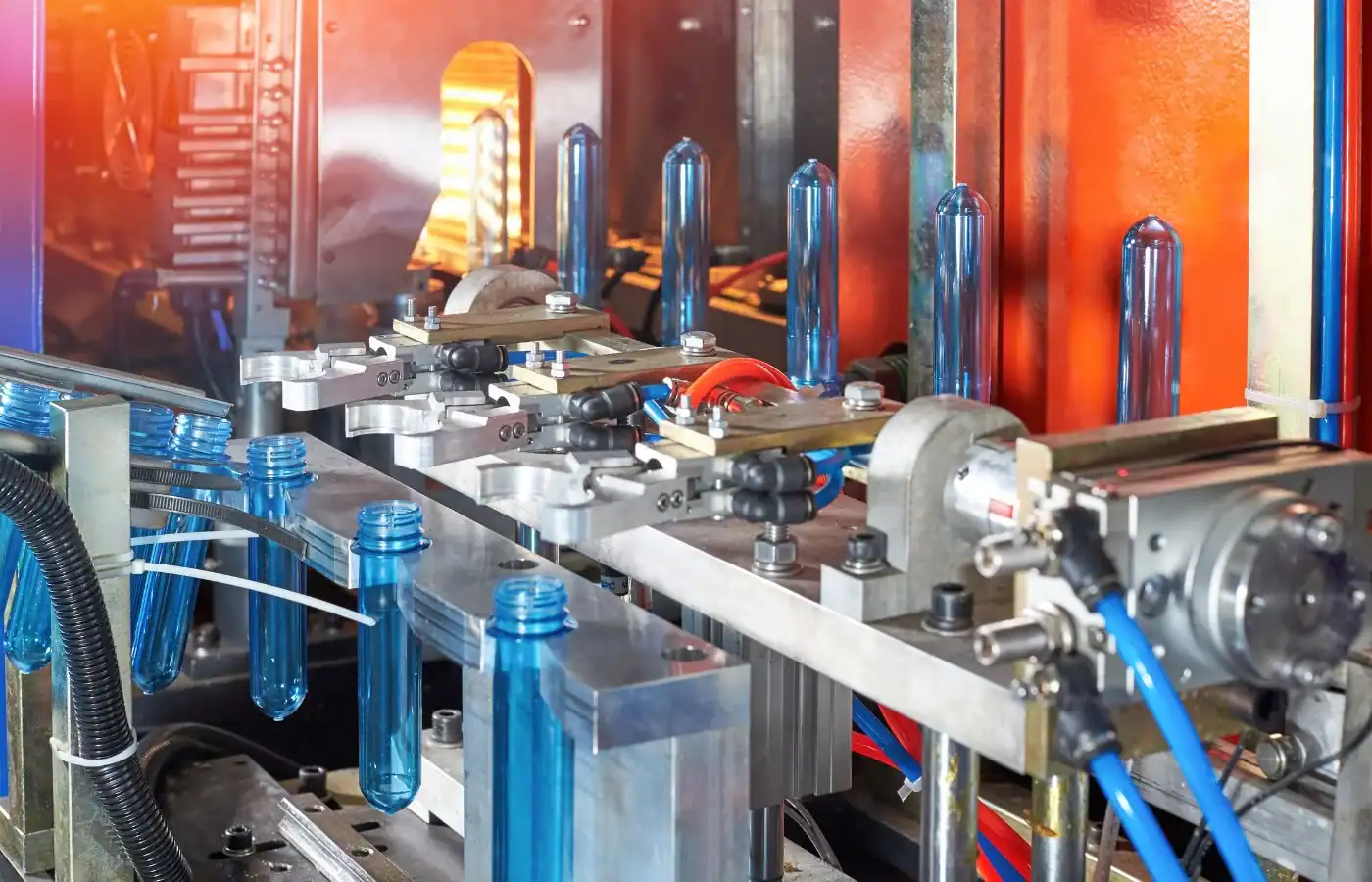

Manufacturing

From engineered parts to full-scale production, we support manufacturers with valuation strategy, growth planning, and exit preparation rooted in operational realities.

Clear Strategies

for a Stronger Future

Grounded in Real Experience

Strategy First

We tailor every strategy to your goals—whether you’re preparing to sell, looking to grow through acquisition, or exploring recapitalization.

Experience Across

Market CyclesWe’ve led transactions during market booms and downturns. Our advice is tested, timely, and built to hold up under pressure.

Sector-Specific

InsightWe know what buyers look for—and what they’ll push back on. That insight helps us defend value and anticipate the next move.

Helping Owners Make Better Decisions

Clarity. Confidence. Execution.

Mergers & acquisitions aren’t just financial decisions—they’re defining moments. Whether you’re ready to sell now or still weighing your options, we’re here to provide the insight, structure, and advocacy to make the right move at the right time.

Let’s Talk About What’s Next

Whether you’re preparing for a sale, planning an acquisition, or just need clarity on what your business is worth—we’re here to help.

For inquiries, reach out to our team:What types of businesses do you represent in M&A transactions?

We primarily work with privately held companies in the middle market, as well as public companies, family offices, and financial sponsors involved in strategic acquisitions or exits.

How do I know if my company is ready to sell?

We recommend a Market Value Analysis and readiness assessment. We evaluate your financials, operations, and market position, then identify steps to improve valuation and appeal before going to market.

Do you work with companies planning to sell in the future, not right now?

Yes. Many of our M&A clients begin working with us 1–3 years before a sale. We offer Value Growth Consulting to help build value in advance of a future transaction.

Can you help me acquire a competitor?

Absolutely. Our buy-side services include deal sourcing, due diligence, financial modeling, negotiation support, and post-close integration planning.

What’s the difference between sell-side and buy-side advisory?

Sell-side advisory helps business owners prepare for and execute a sale. Buy-side advisory supports investors or companies seeking to purchase a business. We do both.

What types of buyers do you work with?

We have relationships with strategic buyers, private equity firms, family offices, and institutional investors across various industries and transaction sizes.

How involved are you during the transaction process?

We’re highly involved—from preparing materials and managing outreach to facilitating due diligence and supporting post-close transitions. Our process is hands-on and comprehensive.

Do you offer valuation services on their own?

Yes. Our Market Value Analysis can be delivered as a standalone service or as the first step in a broader M&A strategy.

Is Your Business Ready for a Sale or Strategic Exit?

Why This 60 Second Form Is Worth Your Time

It’s the first step in exploring a potential M&A transaction with First Turn Capital.

- Uncover What’s Driving Your Valuation

- Spot Operational Gaps That Could Kill a Deal

- See If You’re Caught in the Owner’s Trap

- Understand What Buyers Are Really Looking For

Once you complete the form, a member of our senior M&A team will review it and follow up with a confidential, no-pressure call. We’ll walk through your responses, discuss timing, and share what today’s buyers are paying for, along with what they’re avoiding. Whether you're planning for the future or already entertaining offers, this is a smart place to start.

Stay Ahead with Insights Built for Business Owners

Start the Conversation With First Turn Capital

Thinking about a sale? Exploring growth capital? Planning for something in between? It starts with this form.

Give us 60 seconds, and we’ll help you make your next move with confidence.

Join hundreds of owners and executives who receive our monthly updates. We share practical insights on deal activity, valuation trends, and the strategies successful companies use to plan for a sale or partnership. It’s clear, focused content from advisors who understand both sides of the table.